Make a Difference

Partner With Us

Your involvement in the Building Futures campaign is crucial to its success.

We invite you to support this campaign in the following ways that are most meaningful to you.

Your contribution to the Building Futures campaign directly supports students with diagnosed learning disabilities, helping us build a brighter future. Every gift, whether a one-time gift, a multi-year pledge, or a gift of securities, makes a lasting impact.

Ways to Give

-

One-Time Gift

Many of our donors make annual one-time gifts to the Building Futures campaign. All annual gifts irrespective of gift size support our campaign and are valued and appreciated. Online donations can be made below or cheques, payable to Rundle College Society, can be mailed to:

Attention: Building Futures Campaign Rundle Business Office

7379 17 Avenue SW

Calgary, AB T3H 3W5 -

Gift of Stocks and Securities

Many donors choose to take advantage of the tax benefits of gifts of stocks or securities.

By donating shares directly, you get a larger tax credit and give more to Rundle Academy.

To make a gift of stocks or securities, please click here for a transfer form.

For more information, please email

-

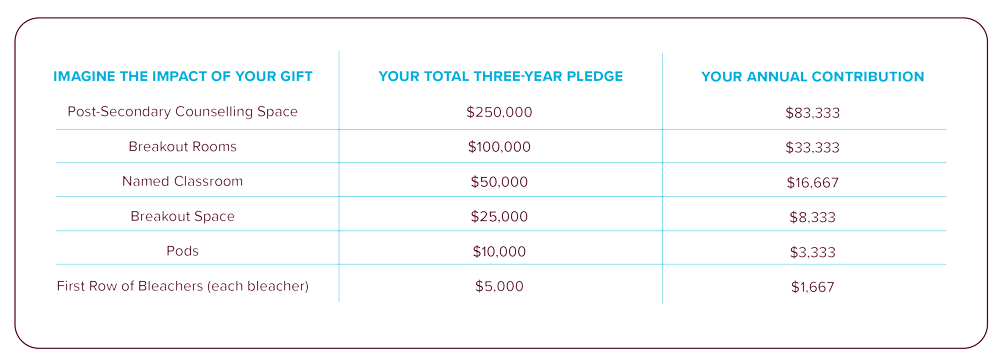

Transformational Gifts

Rundle Academy extends its deepest gratitude to our community members whose transformational gifts are driving the success of the Building Futures campaign. Gifts can be pledged over a three to five-year period. Beyond the tax benefits, donors of transformational gifts receive personalized recognition, including the opportunity to name a space within the new building, ensuring a lasting and meaningful legacy. To explore making a multi-year transformational gift, please contact us to discuss how you can positively impact our students.

-

Corporate Sponsorship & Matching Program

Sponsorships from businesses can include financial support, in-kind donations, or matching gift programs. Please check with your employer to see if your donation is eligible for a corporate matching program and double the impact of your gift. For sponsorship opportunities, please contact us.

-

United Way Giving

You can double your impact by directing your donation to the Rundle Academy Building Futures campaign through your employer’s United Way campaign.

-

Legacy Giving

Including Rundle Academy in your will, trust, or life insurance is a simple, effective, and flexible way to ensure your legacy supports future generations. The benefits? You can modify your gift at any time, enjoy tax savings, and decide whether to contribute a fixed amount or a percentage of your estate. Plus, you can direct your gift to a specific Rundle Academy program or initiative that holds special meaning to you.

Rundle is a registered charity with Canada Revenue Agency. All gifts are eligible for a charitable tax receipt.

Rundle College Society Charitable Number: 107940892 RR RR 0001All.

Don’t forget: You get up to a 50% tax credit for charitable donations.

The first $200 of all your charitable giving entitles you to a tax credit of 25% (10% provincial tax credit and 15% federal tax credit).

You are entitled to a tax credit of 50% for all charitable gifts exceeding the initial $200 (21% provincial tax credit and 29% federal tax credit). Depending on your income level, the tax credit could be even higher.

Rundle Academy tuition fees might be eligible for medical tax credits due to a student's diagnosed learning disability. Some families choose to support the campaign by pledging the saved portion of the tuition fees for a number of years.

Please check with your financial advisor for more information on all matters listed here.

Other Ways to Partner

Attend a Roundtable Session

Learn more about the campaign and how it will leave a lasting legacy for our students at one of our events.

Please email us at buildingfutures@rundle.ab.ca for details on how to register for an information session.

Tell a Friend

Share the Building Futures campaign with your network to help increase our campaign's visibility and support.

All gifts are eligible for a charitable tax receipt.

Rundle College Society Charitable Number: 107940892 RR 0001

Let's have a chat!

Please share your information with us and we will be in touch with you soon. We look forward to connecting with you!